In 22 years at the helm of Hungary’s biggest financial institution, Sandor Csanyi has lived through his fair share of crises in Central and Eastern Europe. But none have been more threatening than the current crisis in Ukraine, which is rapidly destroying OTP Group’s banking operations in the country.

Because of an event that nobody could have predicted, OTP Group is taking a massive hit on its business in Ukraine and in Crimea. The bank’s accountants have had to write off the group’s entire goodwill in the besieged former country, a sum amounting to $111m as the situation worsens.

What will be more serious in the long run, given that Crimea has been annexed by Russia, is that OTP has lost the totality of its operations. It can no longer collect the interest on its loans, let alone call them in. And the strong likelihood is that there will be substantially higher losses over the rest of the year. The problems in the Crimea came as a rude shock for Csanyi, who has presided over more than two decades of mostly steady expansion in his home region. He took over in 1992, three years before the government-owned institution was privatised and sold to a widespread group of mainly private and institutional investors on the Budapest stock exchange.

The problems in the Crimea came as a rude shock for Csanyi, who has presided over more than two decades of mostly steady expansion in his home region. He took over in 1992, three years before the government-owned institution was privatised and sold to a widespread group of mainly private and institutional investors on the Budapest stock exchange.

Flush with cash after the privatisation, Csanyi launched an international expansion throughout Central and Eastern Europe in order to tap one-off opportunities in the financial sector.

In quick succession, mainly through acquisitions, the group moved into Bulgaria, Croatia, Romania, Serbia, Slovakia, Montenegro, Ukraine and Russia. In a fearless period of development, the bank grew to some 1,500 branches, serving more than 13 million customers.

With his sights set on opportunities in Western Europe, Csanyi also steered the group into France through a collaborative deal with Groupama to cross-sell financial and insurance products. Groupama now has eight percent of OTP Group’s shares. The major individual shareholder is Megdet Rahimkulov, the Russian billionaire, with nearly nine percent.

Now 61, Csanyi has prospered almost in tandem with the bank’s growth. With estimated personal wealth of $500m in 2014, he is the wealthiest person in Hungary. A national figure in the country, he is also chairman of the Hungarian Football Federation.

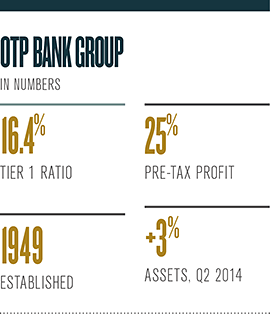

Until the Ukrainian crisis hit, Csanyi’s toughest challenge had been the banking collapse of late 2008, which negatively impacted on so many banks. During that fraught period, he adroitly avoided the worst of the crisis by focusing on boosting deposits and on issues of retail bonds to keep the institution liquid. And, compared with some of the bank’s counterparts in the West, OTP Group had sky-high levels of capital adequacy that served the group well.

But 2014 is a year that Csanyi will not forget. On top of the heavy write-offs in Ukraine, OTP has also lost a bundle on tax obligations encountered in its acquisition of Banco Populare Croatia. For good measure, the Hungarian Supreme Court has delivered a shock judgment that could create further hefty losses in household retail loan market.

Csanyi could now be facing his biggest managerial test, as factors on all sides come together. However, his previous record suggests that he is the right man to deal with them.