The seemingly simple question of what phase we are now at in the property cycle is difficult to answer as Europe emerges from the deep recession caused by the global financial crisis. Economically, there are huge differences between countries (and indeed within countries); persistent low interest rates have had a profound impact on investment strategies in the real estate sector; and the relationship between the investment and occupier markets has been disrupted.

London has been an exception that no other European market has come close to matching

In terms of where we sit in the property cycle, the prolonged period of low interest rates has perhaps had the greatest effect. In particular it has resulted in a significant difference in the performance of bond-like property (long lease to a secure tenant in a strong location where the ability to re-let the property underpins the income) and equity-like property (insecure income stream dependent on a buoyant letting market to drive capital value growth).

Initially in 2008 and early 2009, the value of all types and grades of property fell roughly in sync, but by mid-2009 investors started to recognise that property with long, secure income had been over-discounted relative to equivalent bonds. Since then that segment of the market has seen increasing demand and substantial capital value growth. This has happened across virtually the whole of Europe, with a few exceptions in some of the more distressed European economies. The extent of the re-pricing is such that yields are now a long way below long-run averages – although they are still offering a significant premium over the equivalent bond yields.

Conflicting influences

With the capital markets now looking towards increasing interest rates, it could be argued that this particular segment of the real estate market is getting close to the top of its cycle. However, it is likely that we will see conflicting influences on prices as that starts to happen.

The forecast interest rate rises are predicated on improving economic growth, but that in turn will start to generate increasing occupier demand. So far occupier demand has remained relatively weak in most European markets. New development starts have been at a standstill in most of Europe for the last five years and so this increase in occupier demand will meet a lack of good quality property available for immediate occupation. Although vacancy rates remain quite high in many European cities, tenants taking advantage of lower rents have absorbed most of the high-quality space and released back to the market poor quality and poorly located space that now makes up the vast majority of what is currently available. A rising risk-free rate will therefore coincide with increasing underlying rental value. Historically, it is unprecedented for yields to rise while rental value growth is accelerating.

Within the last year or so – traceable back to the start of 2013 – we have also seen securely let property in Ireland, Spain, Italy and Portugal joining this trend. As the risk of the euro area break-up has receded, investors have been attracted by the significantly higher yields on offer for prime property assets in these markets and there has been a significant flow of capital taking advantage of the differential in pricing. The cycle in these countries is clearly not yet as far advanced as is the case in the rest of Europe, but they are catching up quickly.

Returning investors

Away from the relatively straightforward world of bond-like real estate, the rest of the property market has been behaving very differently and with much more significant geographic differences apparent.

As the perceived economic risk has diminished, so investors’ appetite for risk has started to return. It is notable that in this respect real estate is behind the other main asset classes. The spread between AAA and BBB corporate bonds in the euro area reached its peak as long ago as late 2011 and has shown a continuous fall since then. Similarly in the equities market the performance of the FTSE 250 (mostly low dividend growth stocks in smaller companies) started to outstrip the FTSE 100 (large, blue-chip, dividend producing stocks) from early 2012.

Although there were isolated examples of investors making significant commitments to secondary property, it was not until the middle of 2013 that there were clear signs of this trend spreading into the commercial real estate sector.

The spread of demand for higher risk property has been different both in terms of the grade of property and in terms of location. As might be expected, the expansion of investor demand for higher-risk real estate has been gradual. If one considers a prime property to be one that is of top quality in terms of location (both macro and micro), asset quality and tenure (both lease length and tenant covenant), there are a number of different dimensions along which investors can increase risk.

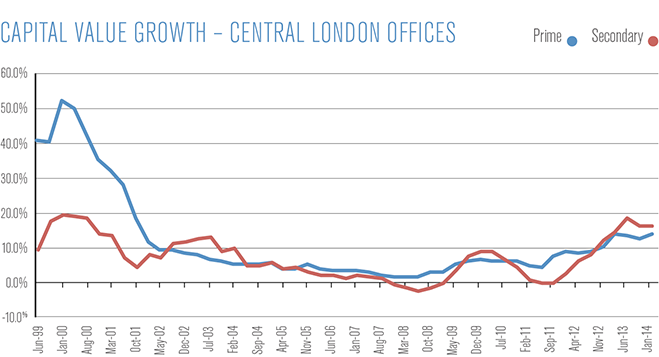

One of the first indications of a higher appetite for risk was the growing interest in the best quality property in higher risk countries (Ireland and Spain). However, it is worth mentioning the Central London market, where from a very early stage there was strong demand for property even a long way up the risk curve. This is perhaps best illustrated by data from CBRE’s Monthly Index. Looking at just Central London offices, capital value growth in the bottom 10 percent (secondary) of property starts to match that of the top 10 percent (prime) of property from around the end of 2010 (see graph).

An open playing field

London has been an exception that no other European market has come close to matching. Elsewhere, the initial moves into this segment of the market were confined to those parts of Europe where the economic recovery took hold first, such as Germany and Sweden. As investors’ confidence in the prospects of re-letting property that might become vacant has improved, they have been happier to acquire buildings with shorter secured income or where the tenant covenant seemed less secure.

More recently there has been an increase in interest in what are termed ‘value-add’ opportunities – typically properties where the buyer is able to increase the capital value of the asset through capital expenditure (cap-ex). Since the start of the financial crisis many owners have not had the available resources to undertake the required cap-ex on their properties. There are also cases where as a result of the fall in capital values in 2008/2009 properties are now over-leveraged (with debts greater than the value of the property). Therefore the owner had no incentive to spend further capital. As credit conditions improve and non-performing loans situations are worked out, these under-invested properties can be repositioned by making the delayed cap-ex.

So where are we in the property cycle? The answer is that different segments of the European commercial real estate market are spread out across the cycle. Some segments appear to be reaching the top as we get closer and closer to interest rate rises. On the other hand, others are yet even to reach the bottom of the last cycle initiated by the financial crisis. As a consequence there are opportunities to suit all risk appetites in the European market as it stands.