Nowadays, passengers travelling from Zurich to Milan can stay on one train for the entire journey, but it wasn’t always so. Differing technical standards and track gauges once got in the way of cross-border rail traffic. Passengers had to change trains at borders and goods had to be reloaded, which took time and brought with it the risk of lost or damaged luggage and freight.

In a similar way, Fides Treasury Services solves the connection challenges faced by treasurers in exchanging data with banking partners. While some banks don’t operate electronically, others do, but use a format or channel that differs from the treasury management software used by the treasurer’s corporation. In addition, every internet banking tool has its own user logic or its own authorisation mechanism. This multitude of channels and formats leads to inefficiency, adding extra effort and expense to a treasurer’s daily tasks.

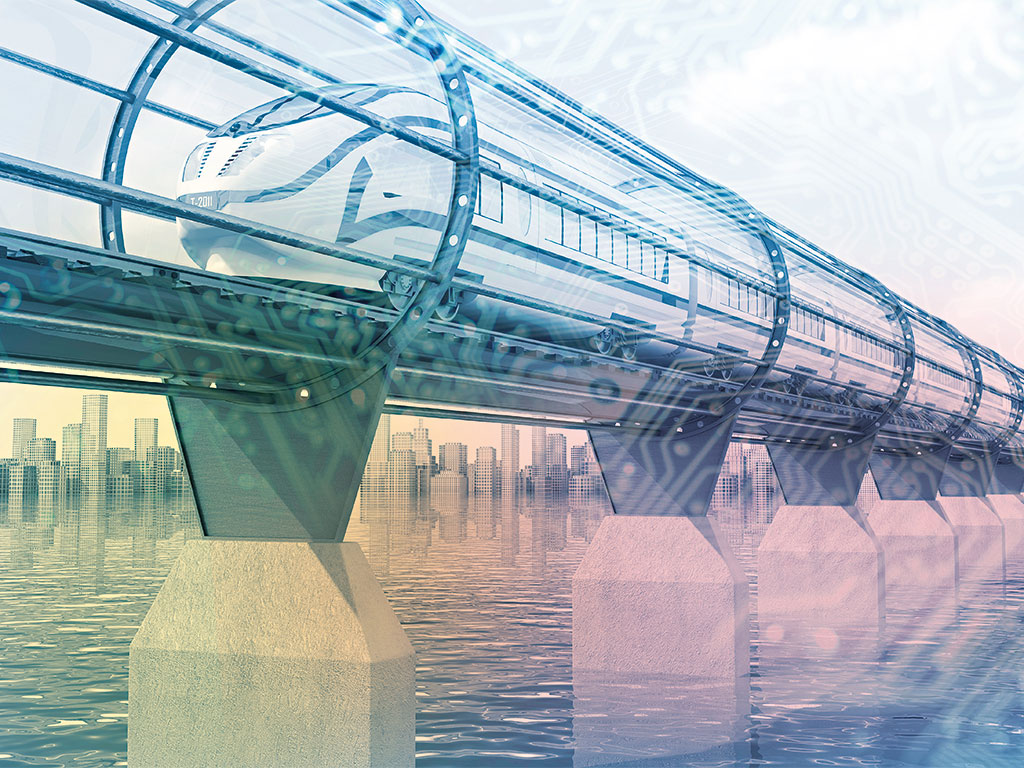

Just as a high-speed train transports people and freight on a harmonised rail network across the country and over the border without interruption, so Fides’ Multibank Solution takes care of lightning fast and highly secure data transfer between a corporation and its banking partners. One tool, one channel, one format – that’s true global multibanking.

A single-track approach

Every treasurer is required to observe various regulations. Processes must be documented for internal as well as external audits, proving the treasurer has taken account of internal risk management as well as external regulatory requirements. The Fides solution allows the treasurer to reduce a multitude of processes into a single standard. This means there’s only one standard process to document, manage and control – no matter how many banks are involved. As a result, the treasurer saves time, money and stress.

Another challenge arises from the fact that a number of countries have negative interest rates. In order to generate value in such an environment, efficient cash management is vital. It is essential to know every day how much cash is available, and where it is. Without this knowledge a treasurer is unable to make the right investment decisions and to generate profit from surplus cash. “Today, money doesn’t take care of itself. We have to keep it constantly in our sights and put it to work”, is how one treasurer described it.

Fides’ solution enables corporations to communicate with all of their banking partners and to operate multibanking effectively – and at a much lower cost than doing things the traditional way. All the relevant banking data can be compiled at the touch of a button, imported automatically into the system and consolidated. The Fides solution also ensures every user receives their data in the desired format and on the right channel. Put another way, Fides customers don’t have to worry about the data format or the data channel of their banking partners.

When the treasurer starts up his or her computer in the morning, it takes no longer than making an espresso for all the necessary data to be available. Fides converts the desired information into easy-to-read reports and exports them on-demand, directly to the treasury management software tool or the enterprise resource planning (ERP) system.

This means the corporate treasury organisation can make quick and well-informed decisions on whether they need to borrow cash for the day’s business, or whether they have surplus cash to invest at the end of the day. And that’s not all: in addition to visibility, with the display of banking data on the treasurer’s screen, Fides services can also be used to initiate bank payments. Decisions concerning such transactions can be made quickly – all the relevant, up-to-the-minute information is available to the treasurer at a glance.

Automation station

Treasurers spend a large part of the working day on the manual collection, organisation, entry and monitoring of banking data. Financial transactions and opening/closing balances, often in multiple currencies and from multiple banks, must be handled. Fides’ multibanking solution releases the corporate treasurer from technical, manual and IT tasks, allowing more time to be spent on the key aspects of the job: control, compliance, analysis, strategic projects, negotiating with banks, forecasting, budgeting, budget monitoring and, last but by no means least, risk management and contributing to financial policy decisions. The latter tasks are among the core competencies and most important tasks of the treasurer, and should never be given short shrift.

Thanks to automation, this doesn’t happen. What’s more, automation prevents manual errors and, on top of that, an integrated Fides service recognises and corrects messages with errors, such as double payments or incorrect bank balances.

The high-speed train replaced the steam locomotive a long time ago, and the magnetic levitation train represents the newest generation of trains to conquer the market. The technology has become complex, and there is no end in sight to further developments. The same is true of the work of a corporate treasurer: he or she must ensure compliance and can only generate added value if technologies are properly deployed. To tackle this, appropriate automation is required.

Outside assistance

Technology, processes and the rules concerning financial transactions change every few years, so businesses must either invest in infrastructure and continual staff training, or hire specialists – effectively buying in more expensive resources. And then, how does a business manage this special knowledge? How does it deal with the loss of know-how when experienced employees leave the company? The answer is preventative; companies must not become dependent on IT solutions and internal financial transaction specialists.

This business hurdle can be avoided by means of outsourcing. Whether an in-house ERP solution needs updating or an entire IT system is to be migrated, and whether bank-side changes or new financial standards are pending, Fides, as a multibanking provider and specialist, allows corporations to complete all the work connected with these tasks with minimal allocation of their own resources. With more than 30 years in the market, no other multibanking provider has been in the business longer. Fides’ solution is bank and software-independent. It places no limitations on clients with regard to the connection used (e.g. Swift). There is no need, on the client side, for specialists or IT professionals.

One further, and no less important, hurdle is the global centralisation of treasury activities. A business needs appropriate solutions to ensure financial control is in order and to know where cash is located. Data security plays a central role here; despite progressive digitalisation and fintech, globally active large-scale businesses must be able to rely 100 percent on the protection and security of their data going forward. This is guaranteed by Fides, thanks to the highest security specifications and the most modern security architecture.