The days of vegan food products being consigned to a meagre shelf at the back of the supermarket are over. The exponential rise in the number of vegans, vegetarians and ‘flexitarians’ – those who follow a predominantly vegetarian diet as part of an active effort to reduce meat consumption – has seen the popularity of plant-based alternatives soar, leaving countless retailers scrambling to cater to the heightened demand.

According to Mintel, 56 percent of adults in the UK ate meat-free or vegetarian products between January and July 2018. Value sales in the meat-free market, meanwhile, are expected to increase by 44 percent between 2019 and 2023, rising to £1.1bn (€1.3bn). Initiatives such as Veganuary and Meat-Free Monday have also impressed upon consumers that the decision to follow a plant-based diet is not all or nothing. Instead, they can make ethically and environmentally conscious food choices on a meal-by-meal basis.

As a result of this shifting mindset, a record-breaking 250,310 people from 190 countries registered for Veganuary in 2019, 46 percent of whom cited health reasons as the principal factor behind their decision to ditch animal products for a month. Rich Hardy, Head of Campaigns at Veganuary, said at the time: “Vegan living is growing – it’s here to stay, it’s part of the national conversation and it has credibility. That’s great news for people, animals and the planet.”

The root cause

While many have been caught off guard by such a rapid rise in the popularity of plant-based diets, for Heather Mills, CEO of meat alternative and vegan cheese company VBites, it has been vindication of a lifestyle she has supported for more than 25 years. The activist and former model first discovered the power of botanical therapies in 1993, after being hit by a police motorcycle that was responding to an emergency call. As a result of the collision, Mills’ pelvis was crushed, her lung was punctured and she lost the lower portion of her left leg, around six inches below the knee.

During her four-month recovery period in hospital, Mills suffered a number of infections that necessitated the amputation of a larger proportion of her lower leg. She was desperate not to lose her knee, as this would have made it far more difficult to have a prosthesis fitted, and so began seeking alternative therapies. “I was willing to try anything at that point,” Mills told European CEO. On the recommendation of a friend, she flew to Hippocrates Health Institute, a controversial holistic treatment centre in California, where she underwent a health regime that centred on a raw food diet and the application of herbal poultices to her wound. “Within two weeks, I was healed,” she said.

Mills continued to follow Hippocrates’ recommended diet for several years, but found it socially alienating. “I began to develop plant-based alternatives to my favourite foods – burgers, hot dogs and such – so I could join in with family mealtimes,” she said. “It took me a couple of years, studying food science and nutrition, but in 1995, I started my own company, VBites, and it’s grown and grown since then.”

Today, the VBites Group is the world’s leading manufacturer of meat, fish and dairy-free alternatives, while its range of more than 140 plant-based products is sold in 24 countries, including the UK, Belgium, Denmark, Germany, France, Italy, the Netherlands, Spain and Sweden. The company produces own-label vegan alternatives for supermarkets such as Morrisons, and provides ingredients for brands including Birds Eye and Goodfella’s. VBites also has its own eponymous collection of 84 plant-based products, which are sold in Holland & Barrett, the largest health food retailer in the UK.

Mills credits her current success to two decades of dogged determination: “[When we started] 26 years ago, everyone laughed at us, but I was convinced plant-based eating was going to be the future. I’d love to claim the mantle for its popularity today but, really, the reason it has grown so much globally is because of huge [mergers and acquisitions].” Mills cited deals such as the sale of vegan cheese alternative Daiya to Japanese firm Otsuka Pharmaceutical for $325m (€289.3m) and US protein manufacturer Maple Leaf’s acquisition of plant-based producers LightLife and Field Roast for $140m (€124.6m) and $120m (€106.8m) respectively.

While among the most notable, these are just a few examples of a spate of deals in the plant-based food market: according to a report by FoodBev Media, acquisitions of plant-orientated companies were four times higher in 2017 than the previous year. Prominent players in the traditional dairy market have also recognised the opportunities to be gleaned from shifting their own business models towards plant-based products.

Danone, for example, announced in October 2018 that it would aim to triple its global plant-based business by 2025, placing a particular emphasis on accelerating the development of non-dairy drinks and yoghurts. “When [corporations] started to see these huge figures, they jumped on the bandwagon – that’s why we’ve seen this colossal 900 percent market growth in the last three years,” Mills said.

Cultivating the market

The growth of Mills’ own business has been slower and more organic. In fact, she has dedicated just as much of her time and energy to supporting smaller businesses through her venture capital firm, VBites Ventures, as she has to expanding her own. Founded in 2006, VBites Ventures seeks to invest in start-ups within the plant-based food sector, providing them with access to VBites’ production line to help significantly lower the upfront costs of growing a fledgling business. According to Mills, founders continue to hold the majority share in their companies.

“We manufacture, sell and distribute for them, and put them into our chain of procurement, so that helps keep their prices down and improves their margins,” Mills explained. As they become part of VBites’ existing production line, these start-ups are also automatically granted the kosher, halal, vegan and British Retail Consortium accreditation that the parent company has earned, eliminating yet another initial cost and potential hurdle.

The foundation of VBites Ventures is part of Mills’ wider goal to ensure smaller brands retain a slice of the plant-based sector as it grows. Put simply, she is keen to prevent the market from being monopolised by multinational corporations, preferring instead to keep it as a hotbed of entrepreneurial activity. “The last thing we want is a whole supermarket aisle of VBites products,” Mills said. “We want a multitude of plant-based brands and we want them all to have a monopoly on the market – not the corporations.”

VBites Ventures is part of Heather Mills’ wider goal to ensure smaller brands retain a slice of the plant-based sector as it grows

Mills sees her venture arm as a middleman, helping smaller brands strike the best deals with distributors. “We can negotiate with the supermarkets in a better way because we’ve had control of a lot of the shelf space for the past 25 years,” she told European CEO. “VBites is a trusted brand, to the point that supermarkets are much more willing to negotiate with smaller companies if they know they’re backed by us.”

To house her growing venture and manufacturing empire, Mills has spent the last few months building what she calls a “600,000sq ft plant-based valley” in the north of England. In March, she purchased a 180,000sq ft factory near Sunderland, the town in which she grew up. The facility, which was formerly owned by crisps manufacturer Walkers, closed down in 2017, leaving around 350 local workers without jobs.

Unfortunately, this is indicative of a wider trend that has afflicted the UK for the past decade, with more than 600,000 manufacturing jobs having been eliminated since 2005. The problem has been exacerbated by the UK’s decision to leave the EU, as a significant number of international companies have shifted their operations back to the continent amid fears of unstable economic conditions.

Mills, who intends to have the former Walkers factory up and running again by Q3 2019, has already rehired a number of those who were made redundant, finding jobs for them on VBites’ production line. “It’s my hometown; it’s where I came from,” Mills told European CEO. “When I found out the factories were closing down, I wanted to try [to] help, [to] get people motivated and create jobs in the local area.”

State support

Despite housing VBites’ headquarters, the UK has only recently become the company’s largest market. Prior to the explosion of plant-based eating in the country, Mills’ business had found greater success in the German and Scandinavian markets, in which veganism and flexitarianism have been on the rise for some years.

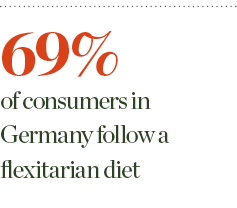

According to Innova Market Insights, 69 percent of consumers in Germany follow a flexitarian diet, compared with 53 percent in the UK. “We launched in Germany around 12 years ago, when a couple of vegan supermarkets had opened,” Mills explained. The offering has grown exponentially since then: according to Mintel, 15 percent of all new food and drink products launched in Germany between July 2017 and June 2018 carried a vegan label, and the number of vegan product launches in the country grew by 240 percent between 2013 and 2018.

“In Germany, the plant-based sector has had a lot of support and awareness from the government, [which is] very much behind it because of the difference it can make for climate change,” Mills said. In December 2018, for example, the German Government invested $780,000 (€694,227) in a research project that aims to make the texture of vegan ‘meat’ more realistic.

The country’s Federal Minister for the Environment, Nature Conservation and Nuclear Safety, Svenja Schulze, has even banned the inclusion of meat and fish on menus at official government functions. Michael Schroeren, a spokesperson for Schulze’s department, told The Guardian: “We decided to take the symbolic step to ban meat and fish at external events because we want to practise what we preach. For us, it was a matter of credibility.”

Mills would like to see similar support from other European states. She pointed to the Canadian Government’s recent Protein Industries Supercluster proposal, under which a research and development complex that aims to develop new sources of plant protein will be constructed, as a good example to follow. The Canadian Government has invested $153m (€136.2m) in the project to date, and expects it to contribute over $4.5bn (€4.01bn) to the country’s GDP, as well as create more than 4,500 jobs, in the next 10 years.

“Governments should be supporting more green, ethical businesses,” Mills told European CEO. “In the UK, there are no grants available for businesses like VBites.” Rather, Mills has been forced to fund her entire business independently from the outset – a daunting prospect when you consider the cost of building production lines. “Cash flow is a huge issue, especially when buying equipment, because you usually have to put down a deposit of 50 percent, which is locked in for six months,” she explained. “That means we can only buy so much equipment at a time, so we can only grow so fast.”

Alongside manufacturing, Mills dedicates a substantial proportion of VBites’ budget to research and development to ensure the company is at the forefront of new biological and technological developments in the plant-based sector. “We began with soy and coconut-based products, then we moved to pea proteins – now, we’re working with algae oils,” she said.

Algae oils are a rich source of omega-3, which has been traditionally thought to only be present in fish and, as such, was challenging for vegans and vegetarians to incorporate into their diets. “There are only three types of algae in the world that contain the same levels of DHA and EPA (omega-3 fatty acids) as fish – we’ve been working with these for some time, but they’re not widespread across the market yet,” Mills explained.

VBites’ current research is focused on microalgae, which, like algae oils, are rich in omega-3, but could also be used to ‘grow’ proteins using specialised underwater fermentation systems. According to the European Algae Biomass Association, there are more than 2,000 companies worldwide that are active in the production and processing of microalgae. Swiss biotechnology firm Bühler, for example, is currently working on a pilot programme that uses microalgae biomass to make pasta with a protein content of 63 percent.

“That’s the ultimate future,” Mills said. “Where you can make fish-tasting products, which have a complete amino acid profile, are very high protein and extremely environmentally friendly, from biomass produced by microalgae.”

Bearing fruit

Despite her many business-related responsibilities, Mills has remained devoted to her public speaking and activist commitments. She is an ambassador of Viva!Health, a vegan advocacy charity, and regularly speaks at conventions on the future of agriculture and plant-based products.

In April, Mills was a keynote speaker at the Forum for the Future of Agriculture at the European Commission, at which she shared her thoughts on how plant-based eating can provide a solution to myriad environmental and agricultural issues. Further, two days prior to her interview with European CEO, Mills was in Milan, speaking at the world’s leading food innovation summit, Seeds&Chips, which is attended by more than 12,000 people every year.

The plant-based food market is on the verge of a wide-scale explosion – something Mills is personally, as well as professionally, very excited by

Mills’ schedule is particularly full at the moment as she is in the midst of launching a vegan cosmetics brand, Be At One. It’s part of a push to expand her empire beyond plant-based foodstuffs into clothing, shoes and other lifestyle products, with the overarching aim of forging a pathway for consumers to adopt a more environmentally conscious lifestyle.

“When someone is plant-curious or decides to pursue a flexitarian lifestyle, they start to consider what they’re putting on their skin, what’s in the wine they’re drinking, what they’re wearing,” Mills said. “We’re providing solutions to those concerns by creating products that help people continue down the plant-based path.”

All Be At One products are 100 percent vegan, meaning they contain no animal derivatives and are not tested on animals – a fact Mills believes marks the line out from its competitors. “Often you’ll see a brand calling itself vegan, but in reality, it’s one lipstick out of 100 products,” she said. “We want people to recognise our brand as the go-to for ethical, environmental and animal-friendly [products].”

No doubt, it’s a strategic move by Mills: by further raising her own profile and expanding her portfolio of businesses, she is extremely well placed to capitalise on any commercial opportunities presented by the burgeoning plant-based food market. Mills is certainly aware that the industry is on the verge of a wide-scale explosion – something that she’s personally, as well as professionally, very excited by. This is perhaps unsurprising, considering she has campaigned for environmental and plant-based causes for more than two decades.

“I’ve waited 25 years for this market to become what it’s become,” she told European CEO. “It’s a movement, not just a trend… In a couple of years, it’ll all settle down and [plant-based eating] will become a natural way of life for people. For the next year or two, as the market grows more and more, it’s going to be a rollercoaster – but I’m enjoying the ride.”