Over the past year and a half, cryptocurrencies have stolen the spotlight in the mainstream media. Once relegated to discourse in online forums and Reddit pages, crypto chatter now makes headlines in national newspapers. This rise to fame was sparked by a meteoric surge in the price of bitcoin: in December 2017, the digital currency hit an all-time high of nearly $20,000 (€17,116), having climbed more than 1,900 percent in just under a year.

Although the price has now more than halved from its peak, the culture surrounding crypto assets has only grown more prominent in the public eye. The new crypto millionaires appear to be young, male and flashy. Rich tech entrepreneurs are gallivanting on yachts in Monte Carlo, celebrating their wealth by ordering bottles of vodka worth tens of thousands of euros.

Naeem Aslam, Chief Market Analyst at ThinkCoin, has spoken at numerous cryptocurrency conferences and attended the “crazy” after-parties. Speaking to European CEO, Aslam likened them to those thrown in The Wolf of Wall Street, a film based on the career – and social antics – of corrupt stockbroker Jordan Belfort. The most intriguing thing of all, according to Aslam, was the fact many of these newly minted millionaires were just teenagers.

A man’s world

Cryptocurrencies are often lauded for having the potential to transform the global financial structure into an accessible and democratic system. However, recent research by trading platform eToro revealed crypto investors were overwhelmingly likely to have one thing in common: a Y chromosome. Women make up just a sliver – 8.5 percent – of crypto investors. According to Forbes, bitcoin investors made $85bn (€72.7bn) in wealth last year, with women sharing just $5bn (€4.3bn) of that total.

Cryptocurrency forums and chats between investors on Twitter and Reddit often feel like a boys’ club, but the culture extends beyond the internet

Online cryptocurrency forums and chats between investors on Twitter and Reddit often feel like a boys’ club, but the culture extends beyond the internet. For instance, in one now infamous example, the North American Bitcoin Conference featured 84 male speakers in 2018, versus just three women. The official after-party – dubbed a “networking party” – was then held at a Miami strip club.

As cryptocurrencies move away from the dark corners of the internet and into the mainstream, women are starting to push back against the ‘bitcoin bro’ image that has come to characterise the industry. Iqbal Gandham, UK Managing Director of eToro, agreed the male-dominated culture behind cryptocurrencies is changing – you just need to look at some of the industry’s leading lights.

Gandham said: “In the past 12 months, at least, I’ve come across more and more women, whether it’s on a development level, a business development level, a tech development level… [or in] the senior positions.”

Gandham named Elizabeth Stark, the CEO and co-founder of Lightning Labs, a firm working to make bitcoin payments faster, and Linda Wang, the co-founder of crypto infrastructure firm Lendingblock, as prime examples. “Could there be more?” Gandham asked. “Yes. Is there still a bias towards men? Yes.”

Hold on for dear life

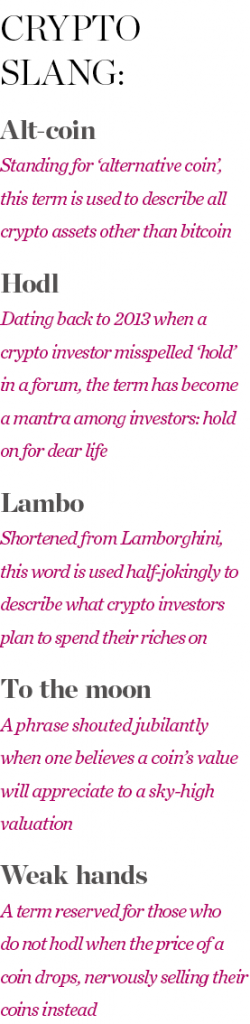

As the culture around crypto investing developed online, a language emerged that pulled the community closer together, creating – in Gandham’s words – a “tribal” effect. “I think with any new innovation, whether we look at when mobile phones first came into being, artificial intelligence [or] now cryptocurrencies, new industries do come up with a new language,” Gandham said.

The words and phrases also act as codes to investors in the know, signifying when an outsider has earned their stripes and can be accepted into the group. “If you meet somebody at an event and they understand the word ‘hodling’, they’re part of the team,” Gandham said. “They’ve done their research and they’ve understood more than the general individual on the street.”

‘Hodl’ is one of the words most commonly used by the crypto community. It originated in an online forum in 2013, when a bitcoin investor misspelled ‘hold’ while frantically typing out his explanation for not selling his coins. Now, the word has taken on new meaning – ‘hold on for dear life’ – and has become a state of mind for many crypto investors who believe the value of coins will always go up in the end.

Another popular term is ‘to the moon’, meaning cryptocurrency prices will appreciate to sky-high values. ‘Lambo’, meanwhile, is short for Lamborghini, and is used in a semi-joking manner to articulate how cryptocurrency investors dream of one day cashing in their investment. The phrases ‘when moon?’ or ‘when Lambo?’ are both ways of asking when a new coin will start to grow in valuation.

“It can be intimidating,” Gandham admitted. “If you’re in a crowd and suddenly people are talking about ‘mooning’ and you don’t quite know what that means – I guess it can be slightly intimidating. But I don’t think the words are offensive in any way, shape or form, and I think eventually they will become mainstream.”

Hitting the street

As hordes of young, often nerdy men start looking to splash their newfound fortunes, many have funnelled into an industry that shares an interesting intersection with cryptocurrencies: luxury streetwear. Streetwear is rooted in youthful, effortless fashion from urban areas. It was popularised in the 1980s and 1990s, taking inspiration from surf and skate culture, as well as the increasing popularity of hip hop.

Streetwear connoisseurs often flaunt casual T-shirts, sweatshirts, baseball caps and trainers but, in the luxury vein, these pieces can cost hundreds or even thousands of euros for a single item. In recent years, streetwear has been adopted as a mainstream style, with luxury brands such as Louis Vuitton, Jimmy Choo and Balenciaga swooping to collaborate. This is no surprise, considering the streetwear market gives brands access to two sought-after categories: Millennials and men.

According to a study by consultancy firm Bain & Company, high-end streetwear helped boost global sales of luxury personal goods by five percent last year to an estimated €262bn. Further, Millennials and Generation Z fuelled 85 percent of luxury growth in 2017. T-shirts, down jackets and trainers were among the year’s standout categories, with sales growing by 25 percent, 15 percent and 10 percent, respectively.

Balenciaga is one luxury brand that has fully embraced the edgy, carefree style of streetwear. At a recent luxury goods conference, Balenciaga CEO Cédrec Charbit said the Millennial and male segments were growing faster than any of the company’s other categories.

A survey by investment bank Piper Jaffray, meanwhile, revealed that teenagers favoured brands embracing the ‘street’ aesthetic. Supreme, one of the sector’s most notable names, jumped three places to rank seventh in the survey.

Speaking to European CEO, Dr Dimitrios Tsivrikos, a consumer and business psychologist at University College London, said crypto millionaires are attracted to streetwear because it screams money and power while still being rooted in reality. Tsivrikos believes crypto investors are looking to understand and engage with fashion, but also “want to be part of a new wave of customers that have one leg in heritage and one leg in contemporary culture”.

As such, the luxury market has been flipped on its head by the streetwear trend, and Tsivrikos believes the industry will have to become more democratic as a result: “The old luxury of being exclusive for the sake of it will definitely shrink as a market. It’s no surprise [when] you see who’s being hired at the moment in key fashion houses.”

Luxury brands are appointing significant people in the streetwear industry as creative directors. And this, according to Tsivrikos, shows brands are “acknowledging the importance and continuation of streetwear as the new way, as the new type of luxury, which has a bigger, broader appeal”.

The relationship between streetwear purveyors and crypto millionaires is not entirely one-sided, either. Earlier this year, California-based streetwear brand the Hundreds featured a blog post on its website singing the praises of blockchain – the technology behind cryptocurrencies such as bitcoin – calling it “era-defining technology”.

After describing some possible adaptations of the distributed ledger technology, the post continued: “This is without even addressing what blockchain could do for small businesses (like the Hundreds) – imagine the cool things you could do with inventory and for customer experience if you could assign each T-shirt or sneaker… a unique and secure global identity on the blockchain that nobody can fake or tamper with.”

Recent research by trading platform eToro revealed crypto investors were overwhelmingly likely to have one thing in common: a Y chromosome

Alongside this statement, the Hundreds announced the release of a crypto-inspired T-shirt, available for purchase in the US with bitcoin and other cryptocurrencies via a Coinbase account. Streetwear brand HYPEBEAST, meanwhile, began accepting bitcoin as early as 2014, claiming the “newfound digital currency [seemed] to have found a lasting presence in the democratic digital landscape”. Other brands, such as Fancy, Jeffersons Apparel and Kicx Unlimited, have also encouraged customers to purchase their products with bitcoin.

When Lambo?

Crypto millionaires are giving in to a more traditional splurge of the elite too: supercars. Ivan Soto-Wright left his traditional job as a risk management consultant in the financial services industry in 2015 to work in fintech.

He made a speculative cryptocurrency investment way back in 2012, when a single bitcoin was worth between $4 (€3.42) and $15 (€12.84). As the price of bitcoin ticked higher, Soto-Wright became increasingly interested in the concept of cryptocurrencies. He eventually founded MoonLambo (later MoonAssets), a company that planned to make it easier for people to buy luxury cars with cryptocurrencies.

Speaking to European CEO, Soto-Wright said: “I saw the most common terms among the trading chat were ‘going to the moon’ and ‘Lamborghini’, so I said why don’t we take those concepts and launch this website and see what happens? Let’s give these guys a marketplace where they can spend their cryptocurrency. And I was just shocked by the take-up.”

Now, Soto-Wright is Managing Partner of Hodl VC, a venture capital fund that is incubating and building MoonAssets. The website currently works as a lead generation platform for dealers that accept cryptocurrency as a means of payment. In the future, Soto-Wright plans to integrate directly with the dealerships, giving them the tools to accept cryptocurrency as a payment.

Soto-Wright said many early crypto investors have jumped to the high-net-worth category, but there are not very many places they can spend their cryptocurrency safely. “Although there’s a slight premium we charge for that service, people are really excited by the prospect of not having to convert their cryptocurrency into cash and being able to spend that directly on the platform we’ve created,” he said. MoonAssets is also looking beyond supercars to more dynamic luxury sectors, with private listings for yachts and even islands already listed on its website.

But not everyone agrees that Lamborghinis and private islands are taking crypto investors by storm. Gandham, who has been involved in the tech industry for decades, said: “I’m yet to find – and I continue my search – anybody in the crypto industry who’s actually gone out and bought a Lamborghini. They haven’t. It’s more of a mythical creature, like a unicorn.”

Gandham said he suspects if one were to go out and buy a Lamborghini, they would be looked down upon in the crypto community. “They’re not your typical investors and traders from the city,” Gandham said. “Those that are serious about developing blockchain technology are very humble.

“The individuals in the industry very rarely talk about money. They very rarely talk about wealth, about how much cryptocurrency they actually own. They talk more about the innovation and the technical side of it – that’s what really sparks their interest. They’re not going to wear Rolexes and Cartier… and go driving around in a Lamborghini.

“For the [individuals] who are [only] interested in money… [cryptocurrency] is just a route to making more money. It’s not about the technology and the innovation. The individuals who are empowered by changing society – the way we work, the way we function – for them, it will always be the technology.” The true crypto believers, it seems, are still hodling.