The glass cliff has similar connotations as the glass ceiling: it represents a gender barrier in business. Coined in 2004 by British researchers Michelle Ryan and Alex Haslam, their work showed women are more likely to be appointed to head up companies facing imminent disaster.

It may be a result of women generally having less opportunity in business and who are therefore more likely to accept risky opportunities, or as the researchers suggest – overt sexism causes women to be appointed so a man’s career is not tainted by the potential fallout of disaster. Either way, the successes or failures of female CEOs have the potential to dismantle gender stereotypes in business, or to ingrain them for years to come.

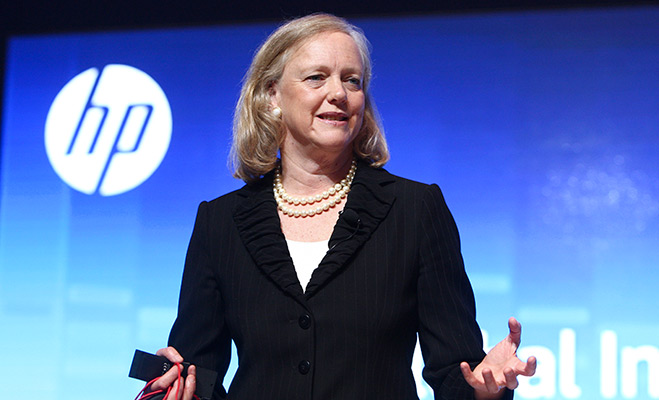

Dominating Silicon Valley

Meg Whitman, CEO of Hewlett Packard – the world’s largest PC Manufacturer – is one of a number of business women heading up major Silicon Valley tech companies that have seen better days. Her work at HP is likely to define many other women’s careers as much as it does hers. HP’s shares have dwindled since the start of the decade. The company used to deal primarily in PCs and printing, and has recently suffered from the emergence of mobile and tablet markets. Consumers are changing how they interact with and share content–computers are becoming more mobile as tablets become popular, and printing is increasingly snubbed by ever-more instant social media.

HP can’t present innovative products to these increasingly essential markets because of a financially stunted R&D department. HP’s previous CEO, Leo Apotheker, attempted a foray into the tablet market with the TouchPad in mid-2011. The TouchPad did so badly in its first month that HP was forced to sell it at less than a quarter of the original asking price–losing $200 per unit. Ironically, the fire sale that followed helped them take second place behind Apple in the tablet market, albeit at a heavy price.

Whitman became CEO of Hewlett Packard later that year. The announcement caused shares of the troubled company to slip further as investors jumped ship. Despite her impressive experience, many argue Whitman’s career doesn’t bring blatant value to HP.

Transferring success

Her previous successes have been in retailing and marketing roles – not PCs, printers and software. She lacks experience reviving the success of a huge company. Since Whitman took command, HP has seen fierce share drops and the biggest quarterly loss in its 73 years. Losses aren’t the only area where Whitman’s making company history. Her proposed method of keeping HP afloat involves cutting 27,000 jobs–roughly eight percent of HP’s workforce, in the largest payroll purge the company has ever seen. Whitman also announced that HP would again brave the tablet market. Rather than go toe-to-toe with Apple, HP will target enterprise customers with a new Windows 8 powered business tablet in what may be the product evolution that HP needs to survive.

The benefits and pitfalls of timing

It’s a dangerous move. Having spent her career building an impressive list of achievements, a move into the young and mostly uncharted tablet market could see her work unravel. However, she has a penchant for attempting the unknown. A younger Whitman wanted to become a doctor, studying maths and science at Princeton. After a summer selling advertisements for a magazine she decided she preferred business, and switched to economics.

In 1997, while GM of Hasbro’s Playskool Division, Whitman received a call from an online classifieds start-up called AuctionWeb. It had 30 employees and revenue of $4m. She was hired as CEO and President in 1998, shortly after it changed its name to eBay. Under Whitman it grew to 15,000 employees and $8bn in revenue. Now one of the world’s largest online retailers, its success is often attributed to Whitman, and is usually the most touted of her achievements, though she did make some misguided decisions.

Her error was acquiring Skype for $4.1bn in 2005. The deal left many confused as to why an online auction website would need a VoIP service. Furthermore, she forgot to include key technologies in the deal, and the two companies became embroiled in a lawsuit. eBay eventually sold Skype for a much reduced $2.75bn, though eBay retained a 30 percent stake. Whitman’s second blunder was refusing to meet PayPal’s asking price of $500m in 2001, instead offering $300m. Changing her mind a year later, she acquired PayPal for three times as much; $1.5bn – an expensive delay that Whitman blamed on her poor negotiation skills.

Whitman left eBay in late 2008, announcing in 2009 she would attempt a career move as Governor of California, despite not voting for 28 years and showing no previous interest in politics. She tried to win the election by steamrolling the competition with her superior monetary resources. Her mostly self-funded campaign was compared to the sort of expensive operation more common to a Presidential election than a Governor position.

Whitman spent more money than any self-funded political campaign in history; smashing Mayor Bloomberg’s record 2010 spend of $109m with her own $144m.

Embarrassingly, she lost by 13 points to Jerry Brown, who spent a comparatively modest $35m. Her failure could be attributed to a number of media exposés that blotted her reputation, including the allegation her son raped a classmate whilst studying at Princeton. The nail in her campaign’s coffin may have been the revelation her Latino housekeeper was an illegal immigrant who complained Whitman treated her ‘like garbage’.

Whitman appears to have spent the last few years on a permanent streak of expensive bad luck, but if she can get HP into the tablet market, then its fortunes might actually change. Turning HP around is a huge and possibly near impossible job, but Whitman definitely shows no signs of slowing, and refuses to be deterred: “We’ve got a lot of work to do. I know we can do it. I’m excited about it. We’ve got great people. We understand the challenges. We’ve got a plan. These things typically take some time. It took us a while to get into this; it’s going to take a while to get out.”